ZenLedger - A Software To Automate Cryptocurrency Tax Filing

ZenLedger - A Software To Automate Cryptocurrency Tax Filing

- Helps to sync your transaction data with the highest number of exchanges

- Helps in calculating your capital gains and losses

- Assists in providing you with accurate profit and loss tax reports

ZenLedger- Leading Software For Digital Currency Tax Management

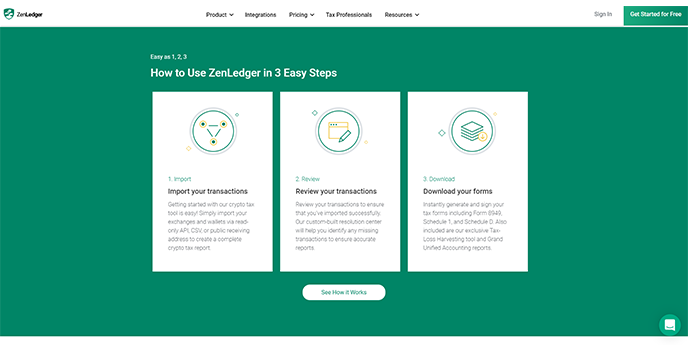

ZenLedger was introduced with the main aim of making crypto tax accounting simple and user-friendly. If you are searching for a seamless way of the tax filing process to save money while staying compliant with the IRS, then you should definitely opt for the services ZenLedger. Even though their downloadable documents are supported in the US, users from other countries still have the right to compute their taxes.

ZenLedger is the best solution that can assist you in covering every type of report you might encounter. This software will also help you handle the math required to report capital gains and losses.

Why Choose ZenLedger?

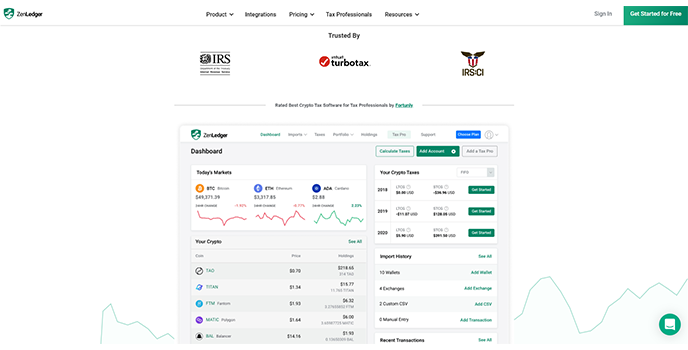

ZenLedger is considered one of the best crypto tax software that allows you to see all your transactions from multiple exchanges within a single easy-to-understand spreadsheet. It can also help you with your non-crypto taxes. You will find prepared plans on their platform for handling both types of taxes. Thus, if you are a professional, ZenLedger could be an excellent choice for providing crypto tax services to your clients because it is easy to use and helps generate the necessary forms.

What Are The Services Offered By ZenLedger?

Integration With Turbo Tax-

An excellent feature of ZenLedger, the leading crypto tax software, is its integration with TurboTax, which is an essential requirement for any crypto tax accounting application. With the help of this feature, you can very easily combine all your crypto tax documentation with the overall yearly tax reports.

Supports DeFi -

ZenLedger is a go-to crypto tax software that supports the evolving world of DeFi. It has no doubt become an emerging segment of the crypto ecosystem and has been great for many users for earning huge. Still, the other reality is that DeFi is also considered the most complex way to use blockchain technology. And being a DeFi user, you will find that ZenLedger can very well manage your crypto tax obligations more automatedly.

Alternatives

Besides ZenLedger, there are Blockpit and Ledgible, two of its great competitors when it comes to crypto tax software. Both software is excellent for getting you organized and compliant with IRS regulations.

FAQs

What are the different applications and services ZenLedger integrates with?

ZenLedger integrates with many applications such as AirSwap, Algorand, Avalanche Bridge, Avalanche Wallet, Bancor, Bibox, Binance DEX, BNB Chain, Bitcoin, Bitfinex, BitMEX, BitPay, Bittrex, Blockchain.com, BlockFi, BRD, and much more.

In Which Countries Is Zenledger Supported?

ZenLedger is known to have explicit support for tax documents in the United States only. But if you are a user from any other country, you can benefit from this software’s ability to calculate taxes owed in other jurisdictions.

Leave a Comment