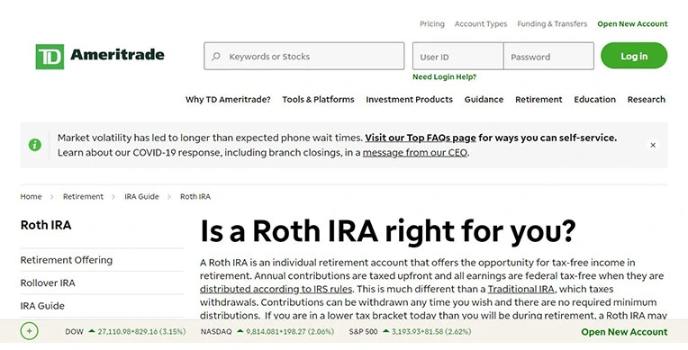

TD Ameritrade - Tax-free Income Withdraw Options For Retirement Account

TD Ameritrade - Tax-free Income Withdraw Options For Retirement Account

- Innovative retirement income solutions

- Offers potential tax benefits for customers

- Flexible investment management portfolio

TD Ameritrade - Ideal IRA Account For Retirement Investment Plans with More Accurate Solutions

As the savings go, an investment today is a source of income tomorrow. So, the earlier you start investing, the future will be good due to the accumulated interest in planning for retirement. A person's retirement account (IRA) permits you to set aside cash for retirement in an assessment advantaged way. Thus, it's ideal to approach setting aside retirement cash by the IRA account, and one of the best platforms would be the TD Ameritrade IRA Account.

Features & Services Of TD Ameritrade IRA Account

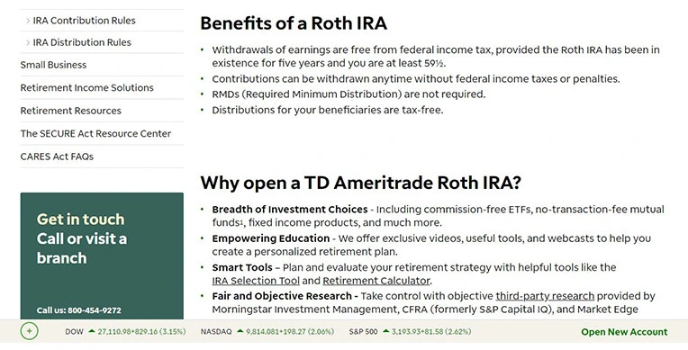

Wide range of Investment options

One of the best investment platforms is a wide variety of investment products like commission-free ETFs, bonds, mutual funds with no transaction fees, and CDs. Furthermore, with appropriate options, one can exchange futures within your IRA.

Offers Smart tools & free analyzers

The use of smart tools for a better-refined investment plan such as the Retirement Calculator and the IRA Selection Tool helps you decide whether Roth or Traditional IRA is a better choice. A free tool 401k fee analyzer to give you a picture of the number of fees paid. Also, they help manage portfolios and provide the best IRA account tax benefits. Choosing TD Ameritrade IRA gives you more investments with no hidden costs and is a completely transparent system.

Flexible, Excellent & secured IRA accounts

Choose the best IRA account that provides maximum income after retirement and has tax-free benefits and growth. Get most of the retirement savings with the best Roth IRA Calculator and Flexible to evaluate income and provide information on tax-free IRA accounts. And one of the best golds IRA platforms provided excellent security to expand the investment for a good value.

Advantages

Modern retirement pay strategies. It Offers potential tax cuts for clients. Flexible management portfolio.

Alternatives

Like so, voya and interactive brokers are flexible, convenient, fast and have ultra-low interest rates, and have effective tax-saving benefits to save for retirement. You can invest, borrow, and use all in the same platform. These tools permit investments, stocks, bonds, which bring in income, so choose what suits you the best.

Leave a Comment