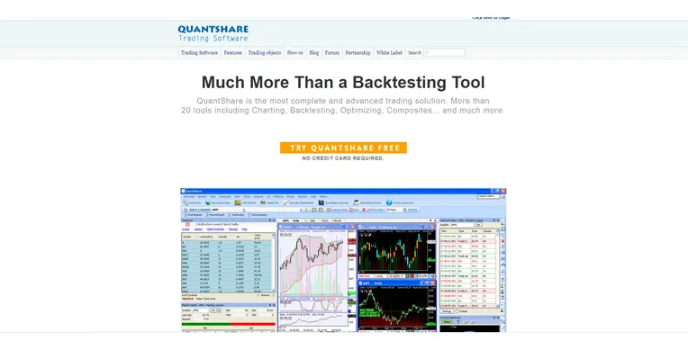

QuantShare – Easy-To-Use Software To Analyze The Trade Market

QuantShare – Easy-To-Use Software To Analyze The Trade Market

- Allows traders to analyze the market

- Helps to create charts, watchlists, portfolios, add indicators, etc.

- It helps you to create a neural network model

QuantShare - Access All The Professional Trading Tools To Make Strategies

Being a trader, finding the best Stock Backtesting Software is most important. Traders can monitor and analyze the market with QuantShare, a desktop application. Charts can be displayed, indicators can be added, watchlists can be created, trading strategies can be created, strategies can be backtested, and portfolios can be created. It works with U.S. and international markets and is suitable for traders of all levels. It is more than just stock trading software. ETFs, Futures, and Options traders can use the platform.

Features of QuantShare

Charting

A user of this Forex Backtesting Software can create as many charts as per their requirement with multiple panes. Combining different symbols and periods in the same chart, one can fully customize their charts. Linked charts can also be created besides arranging them with simple buttons. The trading system can also be displayed and selling signals on a chart.

Drawing tools

Support and resistance lines, Trend Lines, Fibonacci, Gann, etc., are a few of the drawing tools available for use on QuantShare. The same is fully customizable (Color, width, style) with auto support and resistance lines tool. This free backtesting software’s drawing tool can be set as close, high, low, or open price, creating custom drawing tools. One can create both simple and custom drawing tools.

Alternatives to QuantShare

Like QuantShare, eSignal and MultiCharts are other Backtesting software that one can opt for as their market analytical tool. Those are also very compatible.

Leave a Comment